We all go through some kind of hardship one way or another, can be short or long term. Has this caused you to become backed up on your mortgage payments? It doesn’t take long until you get backed up and your house gets foreclosed on. About 3 months actually. Don’t wait and find help now! The Department of Housing and Urban development (or many of you probably heard of HUD) have created many programs that offer a loan modification. Some programs can promise anywhere better 10-50% of your mortgage payment.

We all go through some kind of hardship one way or another, can be short or long term. Has this caused you to become backed up on your mortgage payments? It doesn’t take long until you get backed up and your house gets foreclosed on. About 3 months actually. Don’t wait and find help now! The Department of Housing and Urban development (or many of you probably heard of HUD) have created many programs that offer a loan modification. Some programs can promise anywhere better 10-50% of your mortgage payment.

What is a Loan Modification?

Many of us aren’t aware of programs available to us. Did you know you can apply to modify your mortgage depending on your income? A loan modification is a change with your loan contract with the borrower (yourself) and the lender (bank and or servicer). Loan modifications are usually given to those who qualify after they have documented a hardship which have made them unable to make loan payments. Home Affordable modification plans (HAMP) are available and will help modify by either lowering the interest, the amount of your principal loan or giving you additional time the plan of your current loan.

Do you have to be backed up on mortgage payments to get a modification?

The answer is no. You don’t have to wait until you are backed up. You can take action now.

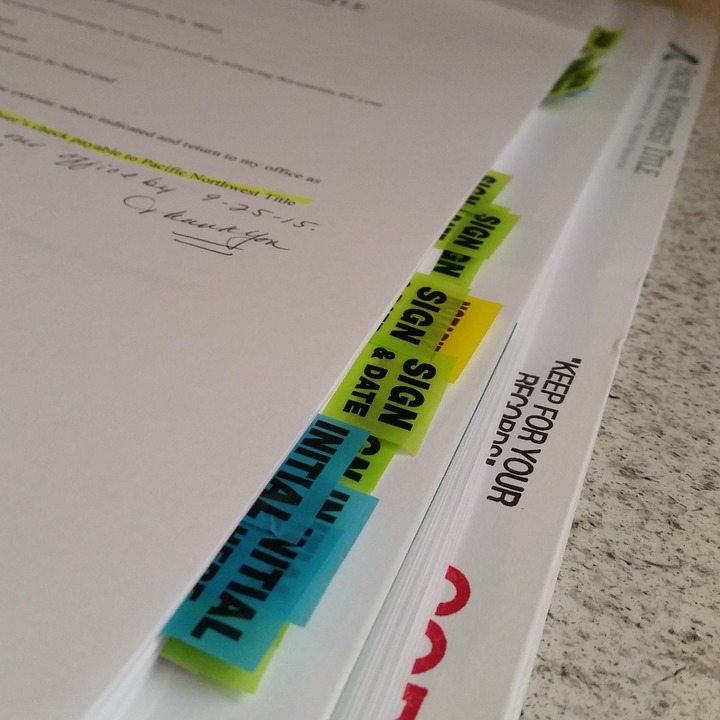

What documents will you need and Who should you contact?

You need to document your hardship. A Hardship letter including reason why you haven’t been able to afford your mortgage payment and date which this hardship began and how it has affected making payments or will affect you. Proof on Income such as paystubs, social security, unemployment award letter and/or tax returns. You need loan information such bills from your mortgage company. Once you have sufficient documents I would recommend calling an Attorney. Having an Attorney will save you the harassment or frequent calls from banks, mediators, and servicers.

What would be considered a hardship?

Some people own homes to live in the property while others own to rent out apartments to tenants. Once you become a homeowner even the small things are up to you. If your renting and your tenant isn’t paying. Chances are those expenses are coming out of your pocket. Sometimes unexpected things happen in life whether its illnesses, you have reduced hours at work or lose your job. Your kids grow up; they move out or even in worst cases your spouse or someone who contributes to your daily expenses passes away. These are all perfect examples of hardship.

Everyone’s dreams of owning a home it’d be a loss to get that taken away because of unexpected hardships. We have to provide our family, our pets and maintaining our homes. If you need a home loan modification or would like to contact an Attorney regarding this matter, our staff at Rosenberg & Hite, LLC is available Monday to Friday to answer your questions and get you help as soon as possible.

Leave a Reply

You must be logged in to post a comment.